Commodities may see increased volatility next week as well with the return of Chinese markets from Golden Week Holiday Commodities remained volatile amid fresh supply tightness concerns, prolonged inflation worries and Fed’s commitment to tame inflation despite fears of recession Recent comments by Fed officials clearly indicate that the financial market instability did not dissuade them from further rate hikes Hawkish message was conveyed by several Fed policymakers this week who showed their resolve in the fight against inflation and reiterated that Fed’s priority remains taming the inflation and they are not prepared to change course.

This prompted a recovery in the US Dollar Index from 110 levels to above 112, while the US 10-year treasury yields bounced back to 3.83 percent from 3.55 percent touched earlier in the week.

Still, commodities have managed to hold on to gains. COMEX Gold prices made a sharp rebound to $1,730.5 per troy ounce from two-and-a-half-year low of $1,622.2 an ounce hit last week. Base metals, too, gained steam in the latter half buoyed by the LME’s decision to restrict new deliveries of the metals from Russia’s Ural Mining and Metallurgical Co and one of its subsidiaries Brent and WTI Crude futures have rallied the most in the non-agricultural commodities space and hold near three-week highs, thanks to OPEC+ output cut of more than expected 2 million barrels per day from November Also read – Wall St Week Ahead | Stay sidelined or scoop up stocks? Investors weigh as market slides Weaker manufacturing PMI readings earlier in the week led to hopes that the Fed may slow down the pace of rate hikes, however, strong ADP payrolls report and repeated hawkish commentary by Fed officials added to signs of undeterred Fed’s monetary tightening expectations The US ADP report showed private companies added more-than-expected 2,08,000 jobs in September, indicating strength in the labour market, while Services PMI expansion remained solid in September at 56.7. On the other hand, the US unemployment claims increased by 29,000 to 2,19,000 in the week ended October 1 and manufacturing PMI declined to 50.9, lowest levels since May 2020. Overall, economic data indicated that US economy is strong enough to weather higher interest rates.

As per the widely watched Fed Watch tool, markets have priced in a 73 percent probability of a 75 bps rate hike in the November meeting and a robust government jobs report due today is likely to push it higher Also, European Central Bank’s (ECB) September monetary policy meeting showed policymakers’ concern that inflationary pressures resulting from a depreciation of the euro might increase further without a timely reduction in monetary policy accommodation Also read – DSP MF strategist’s mantra to beat macro chaos: Keep calm and Besides, global market sentiments may not be too positive as International Monetary Fund (IMF) Managing Director Kristalina Georgieva warned that outlook for the global economy was darkening” given the shocks caused by the COVID-19 pandemic, Russia’s invasion of Ukraine and climate disasters on all continents. In line with the same, she informed that IMF will downgrade its forecast for 2.9 percent global growth in 2023 next week, citing rising risks of recession and financial instability Dollar trend in the coming sessions may largely depend on the incoming data releases especially the non-farm payrolls print from US. Higher-than-expected payrolls figures may only cement the possibility of yet another 75 bps rate hike at the November meeting.

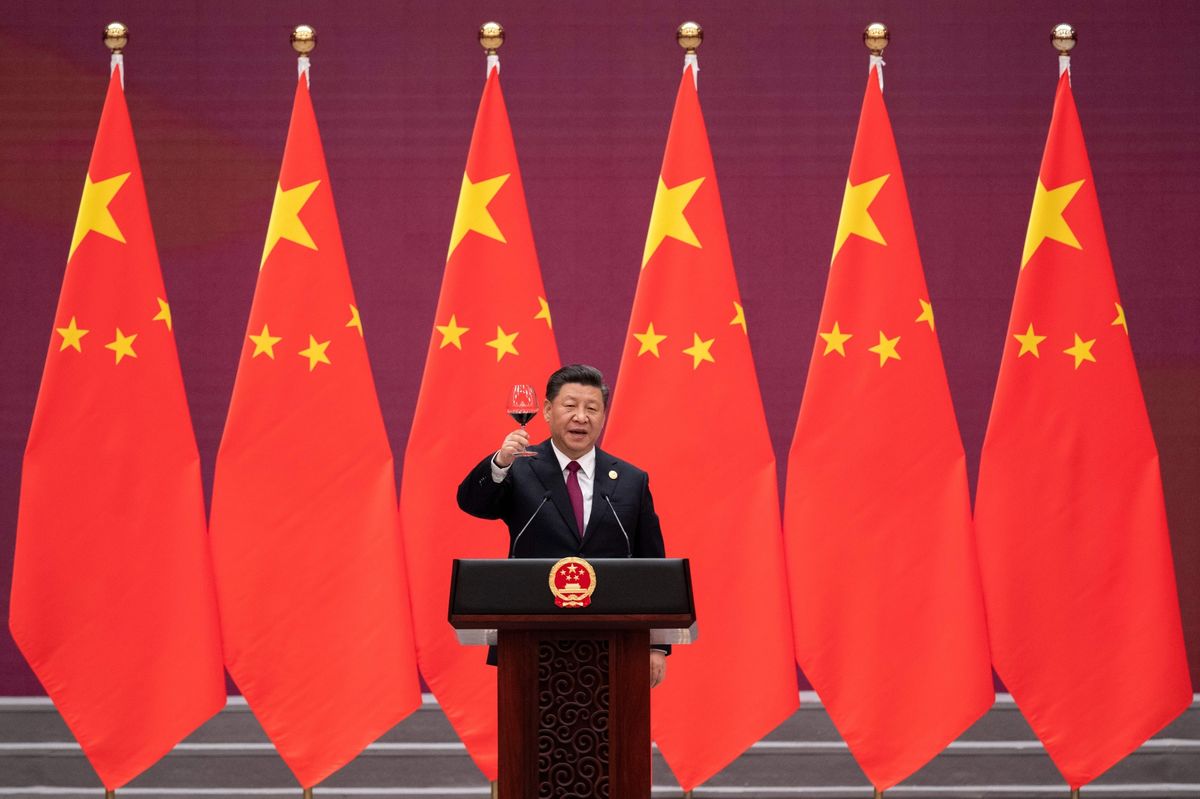

Commodities may see increased volatility next week as well with the return of Chinese markets from Golden Week Holiday. Also, traders may closely watch for US retail sales and inflation data next week for more clues on the US economic situation The views and expressed by investment experts on are their own and not those of the website or its management. advises users to check with certified experts before taking any investment decisions.